andersone

Conductor

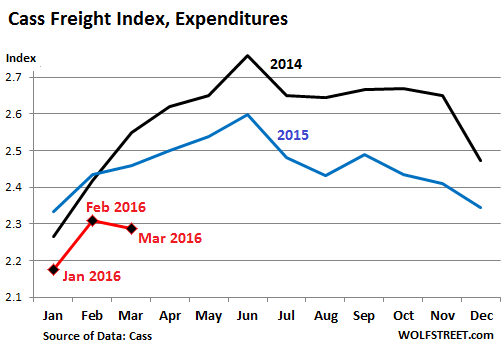

Found this very interesting,,, the current decline of freight rail,,,,,,

http://wolfstreet.com/2016/05/04/freight-rail-traffic-plunges-aar-april-report-photos-idled-engines-transportation-recession/

I didn't think coal was as bad as this,,, I can see why CSX wants to disappear from the region,,m

http://wolfstreet.com/2016/05/04/freight-rail-traffic-plunges-aar-april-report-photos-idled-engines-transportation-recession/

I didn't think coal was as bad as this,,, I can see why CSX wants to disappear from the region,,m